GM, HONDA SEE DEALER-HACK IMPACT AS US AUTO SALES LIKELY SLOW

(Bloomberg) -- General Motors Co. and Honda Motor Co. said a cyberattack last month that hobbled US dealerships impacted their businesses, but the automakers’ results didn’t show much of a hit.

Honda called out the attack on CDK Global’s software in its sales release, saying that it did have an effect without providing specifics. The number of vehicles it sold in the US rose 1.1% last month, increasing Honda’s gain for the year to 9.3%. Meanwhile GM said the hack could push some deliveries into July while its second-quarter sales advanced 0.6% after a decline in the first three months of the year.

These results were part of a mixed bag on Tuesday, with Toyota Motor Corp. and Kia posting declines in US vehicles sold in June. Some automakers report on Wednesday.

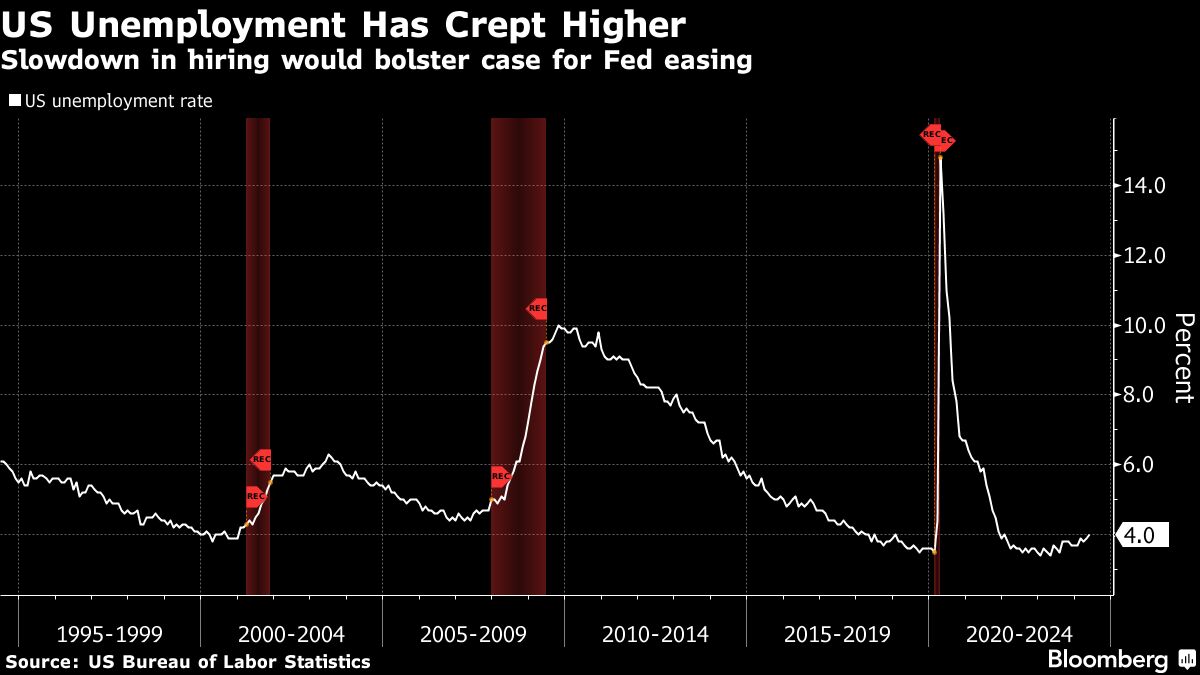

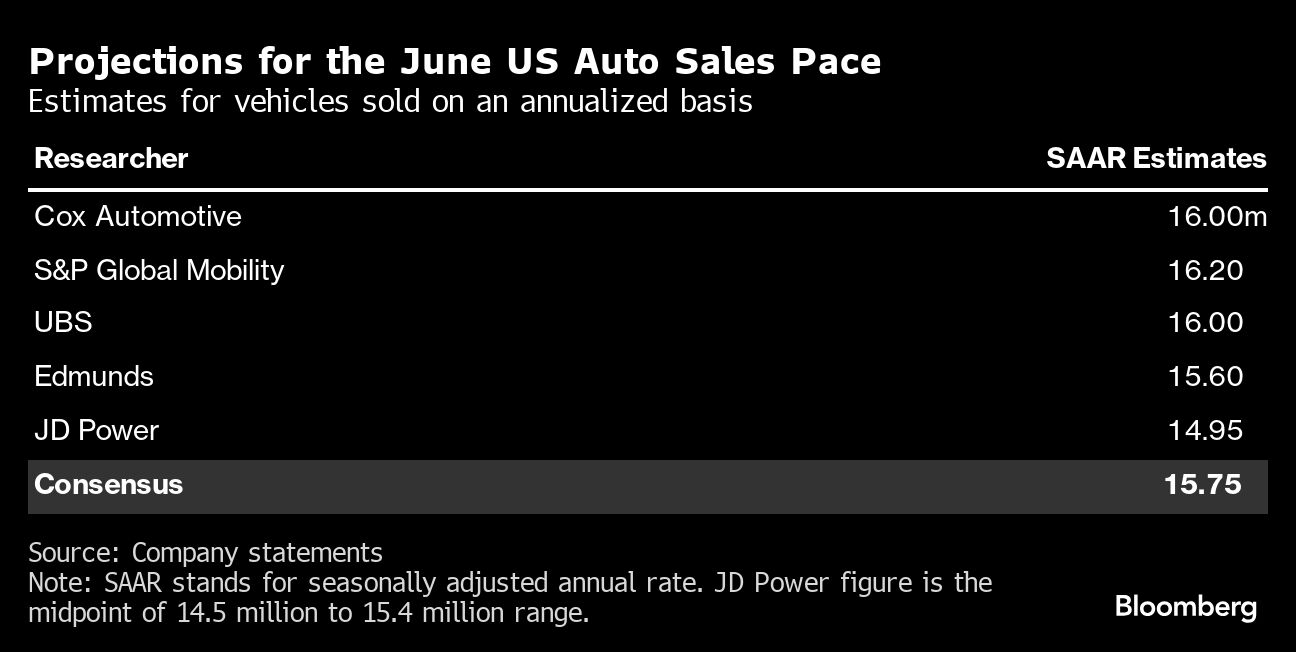

Coming into the reports, a consensus of five market researchers called for annualized rate of vehicles sold in June of around 15.8 million vehicles, down from 16.1 million a year ago. Some analysts see the pace of sales holding relatively steady as shoppers return to showrooms with ample inventory.

Affordability has increasingly been a hurdle for US car buyers. The average annual percentage rate on a new-car loan has risen to 10%, up 1 percentage point over the past year. Automakers have started discounting more to tempt consumers, but many are waiting to see if prices drop further.

Overall pricing is still above 2020 levels, according to Erin Keating, executive analyst with Cox Automotive. That, paired with expectations for further decline, is “quite the recipe for a market that lacks urgency with little incentive to buy right now,” she said.

The hacking of CDK Global forced the software provider to shut down its systems on June 19 and has disrupted thousands of US dealers’ day-to-day operations. The company told customers this week that it expects to be back up by July 4.

“This event is another speed bump on the automotive industry’s long road to recovery,” Jessica Caldwell, the head of insights at researcher Edmunds, said of the CDK attack. “The good news is — unlike other black swan events that the industry has contended with in the past — sales shouldn’t be lost or severely deferred.”

Automakers including, GM, Toyota and Stellantis NV are reporting sales throughout the day Tuesday. Read on for highlights from the manufacturers that have posted numbers thus far.

General Motors: +0.6% in 2Q, -0.4% YTD

Pickups are a major point of emphasis in Detroit, and demand has held up well for GM’s trucks. Chevrolet Silverado deliveries jumped 6.9% for the quarter and 4.8% in the first half, while GMC Sierra sales rose 5.8% and 4%.

Those gains were tempered by tumbling demand for GM’s lucrative large SUVs — the Cadillac Escalade, GMC Yukon and Chevy Tahoe and Suburban all were down for the quarter and the first half.

GM is starting to overcome battery-production problems that have constrained its electric-vehicle output. The company delivered almost 22,000 EVs during the quarter, up 34% from the first three months of the year.

Toyota: -1.2% in June, +14% YTD

The standout number in Toyota’s release: 454,197.

That’s the number of electrified vehicles — hybrids, plug-in hybrids, battery-electric and fuel cell-powered — the company sold in the first half, up 68% from a year ago.

Lexus also had its best showing in the luxury brand’s 35-year history, delivering 167,211 cars and sport utility vehicles.

Honda: +1.1% in June, +9.3% YTD

The company said that a higher percentage of its Acura dealers have been impacted by the hack. Sales for that brand fell 21% in June and have dropped 13% this year.

Nissan: -3.1% in 2Q, +1.9% YTD

Nissan Motor Co.’s deliveries sagged during the quarter largely due to a drop for the Rogue SUV, its best-selling model. Deliveries were down 29% during the last three months and have declined 4.5% this year.

While the Japanese manufacturer did more than double sales of all-electric Ariya SUVs last quarter, Nissan still sells more than nine Rogues for every one Ariya.

Kia: -6.5% in June, -2% YTD

The Hyundai Motor Co. affiliate put a positive spin on a down month and first half, noting that it’s off to its second-best start to any year in company history.

Kia sold more than 5,000 fully electric vehicles for the third consecutive month and more than doubled EV deliveries from the first half of last year. But those gains weren’t enough to declines for its K5 model — the sedan formerly known as the Optima — and the phasing out of the Forte compact. The latter model will be reborn as the K4 sedan late this summer.

Hyundai: -2.5% in June, +1.2% YTD

The company got a big lift from hybrids, which rose 39%, thanks to models such as the Tucson HEV, and electric vehicle sales rose 15%. Hyundai’s sales were up in the quarter and down in June, indicating the CDK hack may have had an impact.

(Updates with cyberattack commentary starting in first paragraph, add Hyundai results in final paragraph.)

Most Read from Bloomberg

- US Allies Allege China Is Developing Attack Drones for Russia

- Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

- Hurricane Beryl Roars Toward Jamaica on Destructive Path

- China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

- Biden Plummets in Leaked Democratic Polling Memo, Puck Says

©2024 Bloomberg L.P.

2024-07-02T10:19:52Z dg43tfdfdgfd