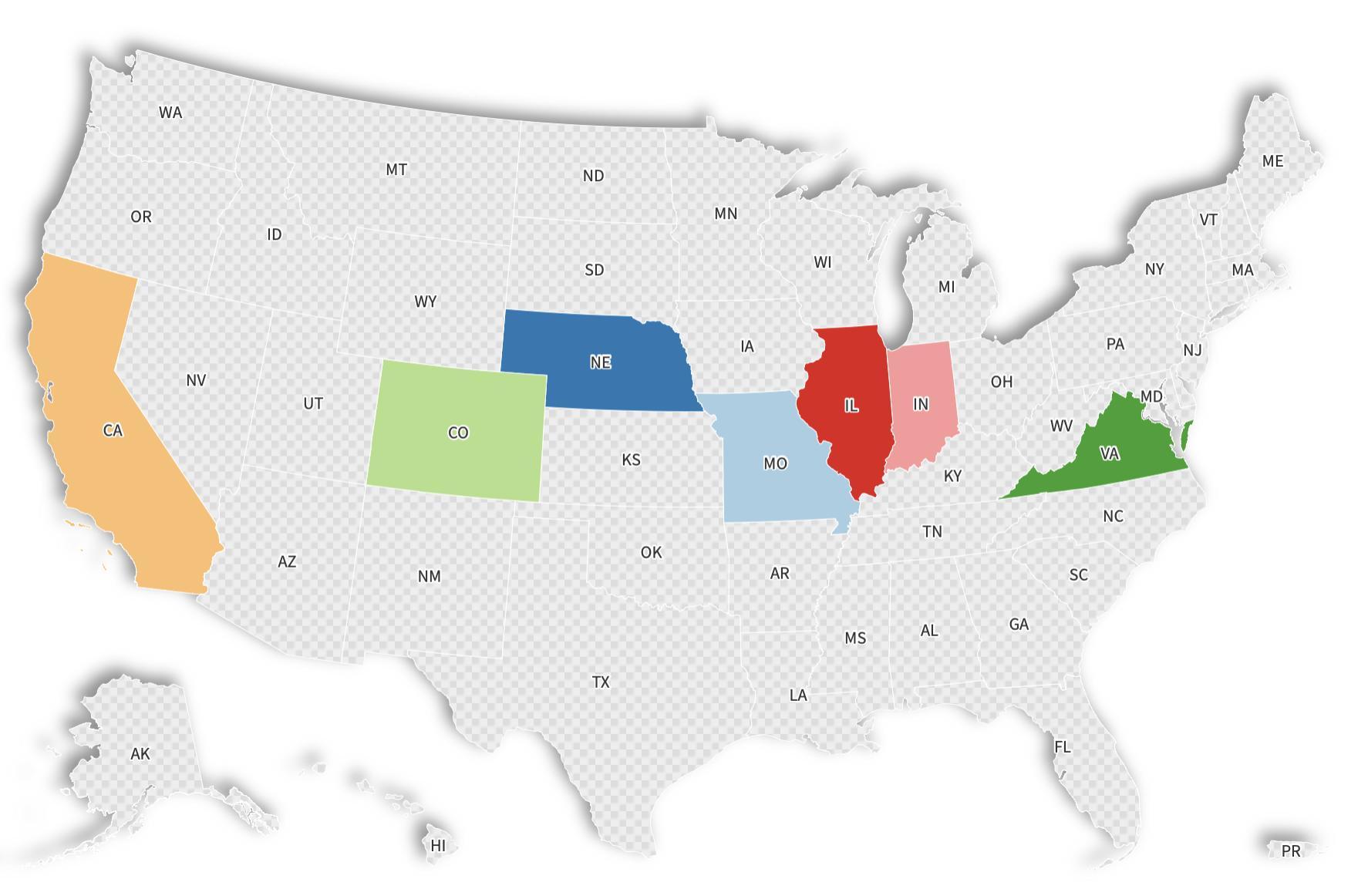

GAS TAX MAP SHOWS INCREASES ACROSS 7 US STATES

Several U.S. states have increased levies on gas starting this month, meaning motorists will be paying more at the pump.

How much fuel costs depends on current oil prices and the cost of refining it—but state taxes on gas also contribute to the overall price at the pump. For example, California has the highest tax rate nationwide on gas, closely followed by Illinois—both of which have increased gas prices this July. Elsewhere, Alaska, Missouri and Mississippi have lowest overall gas tax rates, according to the Tax Foundation.

Read more: Earn up to 5% Cash Back With a Gas Credit Card

Some states have increased gas tax fees per gallon, while others have increased other fees associated with filling up, including environmental and road usage fees. State taxes are levied in addition to the federal gas tax rate of 18.4 cents per gallon of regular and 24.4 cents per gallon of diesel fuel.

The following states have increased levies on gas starting July 1:

California

Tax on filling up your vehicle has increased in line with the Consumer Price Index as of July 1 in California, as it does every year according to state law. Excise tax on gas will rise from 57.9 cents per gallon to 59.6 cents per gallon, the California Department of Tax and Fee Administration has confirmed.

Colorado

While the gas tax fee of 22 cents on the gallon has not increased in Colorado, other levies that contribute to the cost of fuel have. The Colorado Department of Revenue has announced the state's road usage fee, will rise from 3 cents per gallon to 4 cents per gallon. As well as this, the environmental fee will rise from 0.6 cents per gallon to approximately 1.3 cents per gallon.

In total, the state tax on gas will increase from approximately 26 cents per gallon to about 28 cents per gallon.

Indiana

Indiana's Department of State Revenue has increased the gas tax rate to 35 cents per gallon. The additional gas use tax rate has been boosted to 20.1 cents per gallon, making the total tax on drivers filling up 56.1 cents per gallon.

Illinois

The state levy on gas in Illinois will increase from 45.4 cents per gallon to 47 cents per gallon, the Illinois Department of Revenue has confirmed on its website. Diesel taxes have also risen, up from 52.9 cents per gallon before July 1 to 54.5 cents per gallon currently.

Missouri

Fuel tax has risen from 24 cents on the gallon to 27 cents as of July 1, according to the Missouri Department of Revenue website.

Nebraska

Taxes on gas in Nebraska have risen from 29.1 cents to 29.6 cents per gallon.

Virginia

Virginians will now be paying 30.8 cents per gallon, up from 29.8 cents per gallon, according to the Virginia Department of Motor Vehicles. When combined with the state's sales tax rate for gas increasing from 8.7 cents per gallon to 9 cents, it means motorists will now dish out 40.4 cents per gallon in state taxes when refueling.

2024-07-02T11:46:16Z dg43tfdfdgfd