FED’S RATE-CUT DELAY WON’T HOLD BACK THE TIDE OF GLOBAL EASING

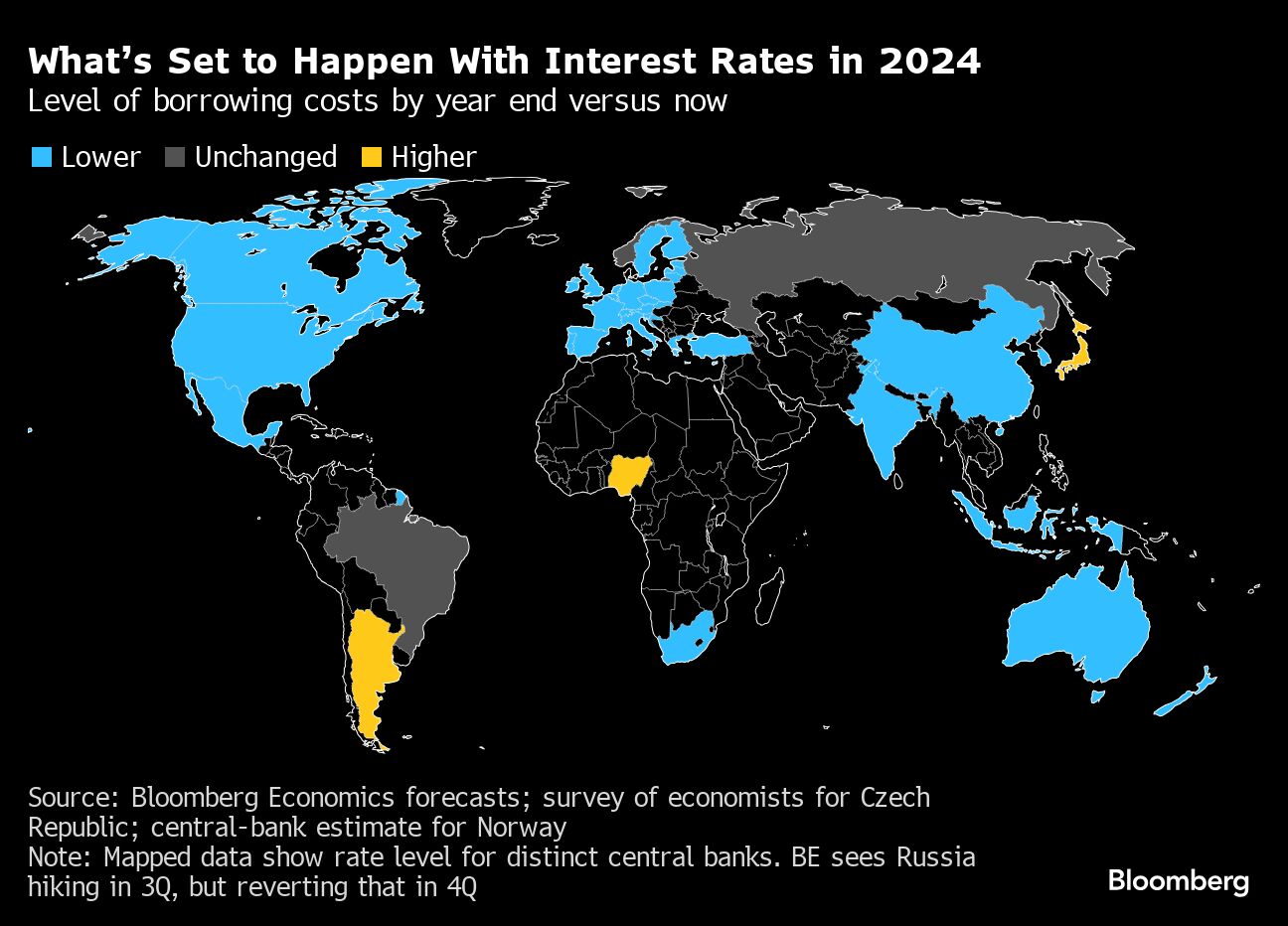

(Bloomberg) -- Global policymakers aren’t about to let the Federal Reserve’s delay in cutting interest rates distract them too much from their own easing efforts.

Among the 23 of the world’s top central banks featured in Bloomberg’s quarterly guide, only the Bank of Japan won’t end up lowering borrowing costs within the next 18 months. Most are already set to do so this year.

In total, 155 basis points will be removed from an aggregate benchmark global rate compiled by Bloomberg Economics by the end of 2025. Even the Fed itself, whose plans for cuts in borrowing costs went awry in the face of stubborn US inflation, will still end up delivering a couple of moves this year, the forecasts show.

What is clear by now is that prospects are dwindling for a swift removal of the unprecedented global tightening delivered during the post-pandemic cost-of-living crisis.

In tandem with the caution of their US peers, central bankers worried about lingering consumer-price pressures are seen adopting a far gentler trajectory downwards for rates than they did on the way up.

Easing throughout the advanced world is also turning out to be relatively unsynchronized. In Europe for example, the Swiss National Bank has already cut rates twice this year, the European Central Bank has moved once, the Bank of England has yet to do so and Norwegian officials just signaled that they’re unlikely to act before 2025.

The global easing push could still suffer further setbacks, as the Fed and ECB have already shown. Australia’s central bank isn’t even ruling out another hike.

What Bloomberg Economics Says:

“Post-pandemic inflation has ripped up the central bank playbook. The normal ‘up on the escalator, down on the elevator’ pattern has been reversed, with rates rising swiftly and falling slowly. The Fed’s pull as a global anchor appears diminished, with the ECB, SNB and many emerging markets charting their own course. The overall picture is cuts coming later, slower and less synchronized than expected at the start of the year.”

—Tom Orlik, global chief economist

But with the second half of the year dawning, the prospect of looser constriction looks increasingly likely to materialize for much of the world. Here is Bloomberg’s guide to the outlook for central banks that set rates for a combined 90% of the global economy.

GROUP OF SEVEN

US Federal Reserve

Current federal funds rate (upper bound): 5.5%Bloomberg Economics forecast for end of 2024: 5%Bloomberg Economics forecast for end of 2025: 4%Market pricing: A quarter-point by November, with 80% chance of another in December.Fed officials have penciled in one rate cut this year, according to the median projection released in June, and all eyes will be watching for clues about whether that could come during the third quarter, toward the end of the year instead, or perhaps even later.

Policymakers have been offering a cautious outlook about the timing for the start of easing after data in early 2024 stoked fears of stalling progress on lowering inflation.

But some Fed officials have highlighted more recent figures that suggest pressures are again weakening. A key measure of underlying growth in consumer prices slowed in May for the second straight month.

Still, some officials have said it’s important not to overemphasize a few encouraging inflation prints. Fed Chair Jerome Powell has stressed policymakers will be relying on a range of data, including on the labor market and prices, as they decide when it will be appropriate to lower rates.

What Bloomberg Economics Says:

“Inflation surprised to the high side early in 2024, and June’s dot plot showed one 25-basis-point cut this year. However, Powell has said ‘unexpected’ labor-market weakening could prompt faster cuts. We see unemployment rising to 4.2% by September, and even with core PCE inflation still above target, the Fed will likely start easing then. We expect cuts in September and December, for a total of 50 bps this year, followed by 100 bps of cuts in 2025.”

—Anna Wong

FOMC Members See Fewer Cuts This Year Than We Do

European Central Bank

Current deposit rate: 3.75%Bloomberg Economics forecast for end of 2024: 3.25%Bloomberg Economics forecast for end of 2025: 2.25%Market pricing: A very high chance of another quarter-point cut in September, and close to three-in-four odds of one more by year-end.Having lowered rates in June for the first time since its spate of hikes, the ECB isn’t rushing to do more just yet.

Inflation, while still in a gradual retreat, won’t sustainably hit the 2% target until near the end of 2025, according to the central bank’s latest batch of quarterly projections unveiled by President Christine Lagarde.

Wage growth, particularly in the services sector, is keeping consumer-price gains elevated and officials nervous about loosening monetary policy too hastily.

A rate cut at their next meeting in July is all but ruled out. That makes September the next opportunity to move.

What Bloomberg Economics Says:

“After upticks in its official time series on negotiated wages, services inflation and compensation per employee, the ECB is reluctant to cut again without more evidence that cost pressures are easing. We expect a pause in July, but slower wage growth in 2Q24 should unlock more action in September. That may be followed by another move in December, when headline inflation is likely to be below target, making such a restrictive stance hard to justify.”

—David Powell

Bank of Japan

Target rate (upper bound): 0.1%Bloomberg Economics forecast for end of 2024: 0.5%Bloomberg Economics forecast for end of 2025: 0.5%Market pricing: Just under one quarter-point of tightening for the remainder of this year, with the next move expected to come by October.The BOJ’s highlight for this quarter could come as early as July.

Governor Kazuo Ueda is set to unveil a plan for quantitative tightening that reduces bond buying at that month’s gathering. A simultaneous rate hike can’t be ruled out.

Currencies are likely to keep complicating the BOJ’s job. The weak yen has already weighed on households and small businesses by inflating import costs, which is one reason the economy contracted twice in the past three quarters.

Japan’s finance ministry has conducted the biggest ever intervention to support the yen in late April and early May.

There are growing market views that sooner or later it will be the BOJ’s turn to take action to support the currency.

What Bloomberg Economics Says:

“The BOJ appears determined to normalize policy. It has a strong conviction that Japan is snapping out of a decades-long period of stagnant prices. Another major motivation is to get rates away from the ‘zero-lower-bound’ to get more flexibility. We think it wants to secure a policy cushion while the CPI readings are solid. We expect the BOJ to raise its rate target by 15 bps to 0.15%-0.25% in July, then to 0.4%-0.5% in October.”

—Taro Kimura

Bank of England

Current bank rate: 5.25%Bloomberg Economics forecast for end of 2024: 4.75%Bloomberg Economics forecast for end of 2025: 3.75%Market pricing: Market wagers favor a 25-basis-point cut in August by a slim margin, with a 75% probability of a second reduction by the end of the year.The BOE teed up a potential August rate cut at its Monetary Policy Committee meeting on June 20. Although the panel voted to leave rates unchanged at 5.25%, two of the nine members wanted an immediate quarter point reduction and, for at least three others, the decision was “finely balanced,” which would give the doves a majority.

The June decision was complicated by the UK election on July 4, with party campaigns in full swing. Although the MPC said that that vote “was not relevant” to the decision, the timing was inconvenient.

Economists believe the principal obstacles to lower rates remain sticky service prices and wage growth, which the BOE is using to measure underlying pressures. Inflation is back at the 2% target but the central bank forecasts it to start rising again before the end of the year.

The strengthening economy, with the BOE projecting 0.5% growth in the second quarter after 0.7% in the first, is unlikely to delay a decision to cut rates because officials believe policy will remain in “restrictive” territory even after the easing cycle begins.

What Bloomberg Economics Says:

“The BOE has sounded increasingly dovish in recent months, suggesting an August rate cut, which is our base case, is firmly on the table. The shift in tone has occurred despite services inflation showing signs of stickiness. We think upcoming data releases would need to surprise materially to the upside for the start of the easing cycle to be delayed. A second cut is likely to follow in November.”

—Dan Hanson

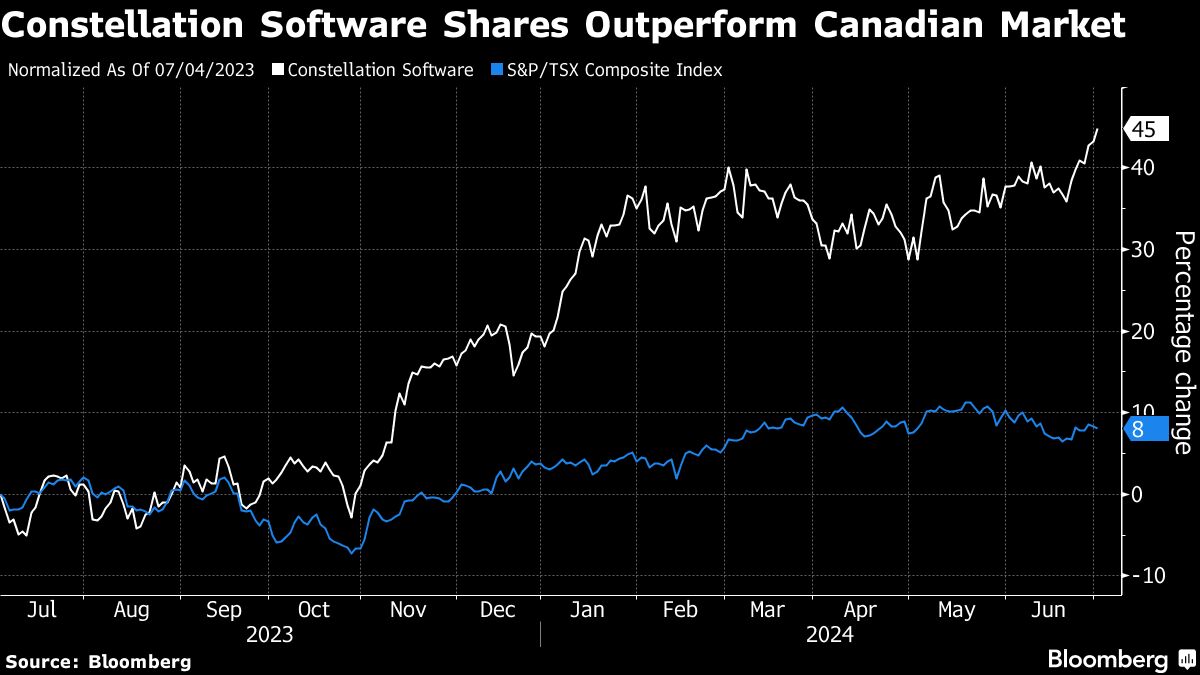

Bank of Canada

Current overnight lending rate: 4.75%Bloomberg Economics forecast for end of 2024: 4.25%Bloomberg Economics forecast for end of 2025: 3.25%Market pricing: Traders see policymakers cutting rates twice more this year, in September and December.In June, the Bank of Canada led the Group of Seven central banks into easing monetary policy, cutting the benchmark overnight rate to 4.75% after it saw mounting evidence of slowing price pressures.

At the time, Governor Tiff Macklem said it was “reasonable” to expect further rate cuts if disinflation continued, fueling speculation that the bank was about to start a sustained divergence in policy from the Fed.

Since then, inflation data has reversed course — in May, the yearly change in the consumer price index surged back to 2.9% and core pressures regained momentum, raising questions about how long officials will have to wait before cutting further.

What Bloomberg Economics Says:

“Robust domestic demand and indicators suggesting a near-term acceleration in spending mean the pace of rate cuts this year should be slow. We expect the BoC to cut policy rates at a quarterly pace, bringing the overnight rate target to 4.25% at year-end. The potential for further downside inflation surprises skew risks for the policy rate lower. But swift rate cuts — amid population growth as a consequence of immigration — could reenergize home prices and risk a secondary inflation surge.”

—Stuart Paul

BRICS CENTRAL BANKS

People’s Bank of China

Current 1-year medium-term lending rate: 2.5%Bloomberg Economics forecast for end of 2024: 2.3%Bloomberg Economics forecast for end of 2025: 2%PBOC officials are walking on a tightrope as they try to balance the need to prop up the currency and stimulate the economy.

The Fed’s rate-cut delay continues to pressure the yuan. Meanwhile, China’s growth recovery remains lopsided, with exports and the broader industrial sector rebounding faster than consumption, reflecting sluggish domestic demand.

Many economists still see the PBOC lowering rates this year, but not until the Fed gives a clearer signal of rate cut plans.

The PBOC could also be preparing for a major shift in how it manages money and liquidity, though the changes hinted by Governor Pan Gongsheng may not necessarily help address immediate problems such as deflation and weak borrowing demand.

What Bloomberg Economics Says:

“The PBOC’s extended rate hold despite economic weakness has fired up a debate over the reason. Pan’s remarks in mid-June made it clear concerns about exchange-rate stability have dominated policy deliberations. This reinforces our view that the next window for the PBOC to reduce rates is September, when our US team sees the Fed starting its easing cycle. Lower US rates may make it less likely that a PBOC rate cut will hurt the yuan.”

—Chang Shu

Reserve Bank of India

Current RBI repurchase rate: 6.5%Bloomberg Economics forecast for end of 2024: 6%Bloomberg Economics forecast for end of 2025: 5%The RBI paused in June for the eighth straight review, awaiting inflation to ease further. But two rate setters in the six-member monetary policy committee voted for a cut and change in stance, indicating a pivot is being discussed more actively.

Governor Shaktikanta Das had said that a shift could be considered when the RBI is sure that inflation, which is moderating but not fast enough, will settle around its target 4% on a durable basis. At an event on June 18, he said it will be “too premature” to consider changing the stance and advocated shunning “any kind of adventurism.”

That may translate into a longer wait for rates to come down from a four-year high of 6.5%. The July budget will be crucial to gauge if Prime Minister Narendra Modi is pursuing a loose fiscal policy to gain popularity after his party lost its majority in Parliament in the recently concluded elections. That will probably put pressure on the central bank to ease too without waiting for the Fed to cut rates first.

What Bloomberg Economics Says:

“Growing calls for a rate cut on the RBI’s rate setting committee is a clear sign of a policy pivot ahead. The consensus is for no sooner than October, but our analysis of dissent patterns suggests an earlier start in August. Slowing growth, retreating inflation and capital inflows stemming from India’s inclusion in a key bond index should allow the RBI to cut by 50 basis points before year-end, regardless of what the Fed does.”

—Abhishek Gupta

Central Bank of Brazil

Current Selic target rate: 10.5%Bloomberg Economics forecast for end of 2024: 10.5%Bloomberg Economics forecast for end of 2025: 9.5%Brazil is expected to keep borrowing costs steady through most of 2025 after policymakers unanimously voted to halt their easing campaign on June 19.

The show of unity was seen as an attempt to assuage investors who started questioning the bank’s inflation-fighting credentials in May, when all four board members appointed by President Luiz Inacio Lula da Silva were against the decision to slow down the pace of rate cuts.

By the end of the year, Lula will have appointed the majority of the board’s nine members.

The interruption of rate cuts is fueling more political tension between the government and the monetary authority.

After the decision, Lula escalated his attacks against central bank chief Roberto Campos Neto, describing him as a “political adversary” who seeks to hurt the economy with high rates.

What Bloomberg Economics Says:

“We expect Brazil’s central bank to stay on hold until mid-2025, when it resumes a gradual easing and brings rates close to their neutral level by year-end. Realistic revenue estimates and restrained spending in the 2025 federal budget proposal due at the end of August would ease market concern on the fiscal outlook. Market-friendly appointments to three seats on the BCB board opening up at year-end could help tame inflation expectations and pave the way for cuts in 2025.”

—Adriana Dupita

Bank of Russia

Current key rate: 16%Bloomberg Economics forecast for end of 2024: 16%Bloomberg Economics forecast for end of 2025: 13%The Bank of Russia looks poised to start the third quarter by hiking its key rate, which has been held at 16% so far this year.

While analysts had earlier expected monetary easing to begin in the second half, accelerating inflation that reached 8.3% in May — more than double the bank’s target — is forcing policymakers into a rethink.

Governor Elvira Nabiullina warned in June of the possibility of a “significant” hike at the July rate meeting if inflationary pressures don’t start to ease. Russia’s war in Ukraine continues to overheat the economy and stoke inflation, with persistent labor shortages fueling a salary race and government spending on the rise.

What Bloomberg Economics Says:

“Markets are likely to pressure the Bank of Russia into hiking the policy rate as high as 18% over the summer — with swaps expecting rates to peak at 19% this year. The sovereign-debt market and Russian households increasingly are convinced the central bank won’t bring inflation back to its 4% target in coming years. Recent upside inflation surprises only reinforced high inflation expectations. To rebuild its credibility, the Bank of Russia will likely raise the policy rate to 17% in July.”

—Alexander Isakov

Russian Markets See Policy Rate Reaching 19%

South African Reserve Bank

Current repo average rate: 8.25%Bloomberg Economics forecast for end of 2024: 8%Bloomberg Economics forecast for end of 2025: 7.5%The SARB is set to maintain borrowing costs at 8.25% for a while longer, although a path to rate cuts may be opening.

A stronger rand fueled by the formation of a market-friendly coalition government after May 29 elections failed to produce an outright winner, and easing price pressures will help moderate inflation toward the central bank’s desired 4.5% goal.

Governor Lesetja Kganyago has vowed that the bank will only adjust course on rates once inflation, currently at 5.2%, is at the midpoint of its 3%-6% target range.

“We will continue to deliver on that mandate, irrespective of how our post-election politics plays out,” he said recently.

What Bloomberg Economics Says:

“The SARB is set to start trimming its policy rate later this year. A new market-friendly coalition government promises cooler food inflation and a stronger rand. That, in turn, is likely to help push headline inflation down to the mid-point of the central bank’s 3-6% target by 4Q24, prompting policymakers to kick off their easing cycle with a 25-basis-point rate cut in November.”

—Yvonne Mhango

MINT CENTRAL BANKS

Banco de Mexico

Current overnight rate: 11%Bloomberg Economics forecast for end of 2024: 10.5%Bloomberg Economics forecast for end of 2025: 8.5%An unexpected currency crisis triggered by post-election uncertainties is the latest obstacle for Mexico’s central bank to keep easing monetary policy.

Banxico, as the bank is known, started its easing cycle with a quarter-point cut in March, but hasn’t been able to deliver additional reductions since then.

The outlook has been complicated by inflation that’s accelerating again and by delays in the Fed’s own easing campaign, which has strong implications for the economy of its southern neighbor.

Yet Banxico Governor Victoria Rodriguez remains hopeful that a more stable peso combined with slower core inflation will allow the bank to cut rates in the coming months.

What Bloomberg Economics Says:

“We expect decelerating inflation, weaker domestic demand and lower US rates to open the door for Banxico to cut in the second half, after it opted for a single, 25-basis-point reduction in the first. Persistent core price gains and inflation expectations as well as risks from potential constitutional reforms and the US elections in November limit its room to maneuver.”

—Felipe Hernandez

Bank Indonesia

Current 7-day reverse repo rate: 6.25%Bloomberg Economics forecast for end of 2024: 6%Bloomberg Economics forecast for end of 2025: 4.75%The prospect of further rate hikes still looms large over Bank Indonesia despite policymakers’ signals that its next move will likely be a cut.

Among the few major central banks whose main mandate is currency stability, BI may be forced to tighten monetary policy anew despite low inflation as the rupiah continues its slide to four-year lows.

Repeated market interventions will be limited by the central bank’s foreign-exchange reserves. Meanwhile, BI’s sale of high-yielding securities has proved insufficient to turn the tide on foreign flows, with investors still jittery over the incoming government’s plans to pursue looser spending and higher debt.

There may be little respite for the currency until the Fed finally pivots and Indonesia’s new administration clarifies its fiscal stance when it takes power in October.

What Bloomberg Economics Says:

“Bank Indonesia is likely to cut rates by 25 bps in 2024, but it won’t move until after the Fed starts easing. Jumping the gun would narrow the rate differential – undercutting the rupiah, which it’s worked hard to prop up. Capital inflows are also vulnerable to concerns that fiscal policy won’t be as prudent under the new government, which takes the helm in October. This likely keeps the BI rate unchanged in 3Q24.”

—Tamara Henderson

Central Bank of Turkey

Current 1-week repo rate: 50%Bloomberg Economics forecast for end of 2024: 45%Bloomberg Economics forecast for end of 2025: 25%After keeping its rate on hold for a third straight month, the Turkish central bank’s eyes will be on June’s inflation print.

Though headline inflation is set to slow from a peak of above 75% in May, the bank’s preferred gauge is monthly readings.

Domestic demand is still too high for officials’ liking, and rate cuts are not expected to be on the table until the end of the year.

The monetary authority has pledged to preserve a tight stance until a sustained decline in the underlying trend of monthly price growth. Investors are also seeking bolder steps on the fiscal side to aid the disinflation efforts.

What Bloomberg Economics Says:

“The CBRT’s rates may have peaked already in March at 50%, but its tightening cycle is far from over. We expect the central bank to restrict financial conditions further via alternative tools, such as higher reserve requirements, likely through 3Q24. We see a total of 500 bps of cuts in 4Q24, but risks to the inflation outlook including outsized mid-year tax hikes may delay the expected kickoff to rate cuts.”

—Selva Bahar Baziki

Few Points of Agreement on Turkey Rates Outlook

Central Bank of Nigeria

Current central bank rate: 26.25%Bloomberg Economics forecast for end of 2024: 27.75%Bloomberg Economics forecast for end of 2025: 22%Signs that decades-high inflation may be peaking, and relative stability in the naira, suggest the Central Bank of Nigeria’s unprecedented tightening cycle is nearing an end. The bank has lifted rates by 1,475 basis points since May 2022.

While Governor Olayemi Cardoso wouldn’t be drawn in a recent Bloomberg TV interview on whether that could be as soon as the Monetary Policy Committee’s next meeting in July, he did say the central bank is “relatively pleased” with the results so far in addressing currency volatility.

Data will direct whether the panel sees the need for further hikes or not, he added.

“The MPC has been very clear in stating that they see inflation as a major impediment for the future of Nigeria, and they will do everything possible to ensure that they keep inflation in check and in fact bring it down as reasonably as they can and I don’t see that changing,” Cardoso observed.

What Bloomberg Economics Says:

“Nigeria’s monetary policy rate is nearing its peak. Rhetoric from the central bank suggests policymakers believe they are winning the fight against price gains. Inflation has indeed slowed — our forecast shows it topping out just under 35% in mid-2024 — on moderating food price gains. We expect the rate hiking cycle to conclude at around 27% in July, followed by a pause. Policymakers will likely keep rates on hold until the end of 2024.”

—Yvonne Mhango

OTHER G-20 CENTRAL BANKS

Bank of Korea

Current base rate: 3.5%Bloomberg Economics forecast for end of 2024: 3%Bloomberg Economics forecast for end of 2025: 2.5%The BOK could be among the first in Asia to join the ECB and the Bank of Canada in making a policy pivot if inflation slows as expected later this year.

In May, the central bank kept the door open for a rate cut by leaving its consumer-price forecast unchanged, even as it raised its economic growth projection.

Governor Rhee Chang-yong said June 18 the BOK could give a clearer outlook when the board meets in July.

A growing number of economists expect a cut in August. Still, concerns about a rate differential with the US and its effect on the won could make the BOK wait longer until the Fed acts more firmly.

What Bloomberg Economics Says:

“The Bank of Korea is gearing up for an easing cycle as inflation slows. We expect it to start cutting rates in August but concerns about won depreciation linked to moves by the Fed could shift the timing. It will probably proceed only gradually due to worries about stoking excessive private-sector debt.

The BOK will probably also use liquidity tools and lending programs to ease property market risks, lessening the need for deeper rate cuts.”

—Hyosung Kwon

Reserve Bank of Australia

Current cash rate target: 4.35%Bloomberg Economics forecast for end of 2024: 4.1%Bloomberg Economics forecast for end of 2025: 3.1%The RBA increased rates by less than key developed-world counterparts during the 2022-23 tightening cycle, and as a result is likely to have to keep them higher for longer to return inflation to target.

Governor Michele Bullock certainly isn’t ready to talk about easing yet. Indeed, following the June policy meeting she restated that the board isn’t “ruling anything in or out,” a signal that another hike may still be on the table.

Economists and money markets see the risk of a hike at the bank’s next meeting in August though the broader consensus is that the next move will be down — though not until 2025.

That will likely make the RBA one of the last major institutions to embark on an easing cycle.

Before its Aug. 5-6 meeting, the RBA will have seen a key second-quarter inflation reading; an unexpected spike in prices could yet force its hand on a hike one last time.

What Bloomberg Economics Says:

“Recent upside surprises in the monthly inflation data have raised the risk of the Reserve Bank making one more hike as insurance. That would come at a cost to growth – with the economy already weak. The 2Q inflation reading will be a make-or-break catalyst for the August decision. We think the RBA has done enough and the next rates move is down, potentially as early as 4Q.”

—James McIntyre

Central Bank of Argentina

Current key rate: 40%Bloomberg Economics forecast for end of 2024: 70%Bloomberg Economics forecast for end of 2025: 55%Argentina’s central bank has been cutting rates aggressively — from 133% when President Javier Milei took office to 40% currently — even as consumer prices continue to rise at an annual clip of 276%.

The negative real interest rate is part of a government strategy to reduce central bank liabilities by forcing investors into Treasury notes that pay higher yields.

Monthly inflation has slowed down to 4.2% in May, a level not seen since 2022, but the relief may be short-lived as the removal of generous energy subsidies is expected to put pressure on prices again.

The International Monetary Fund has also said Argentina will eventually need to have positive real interest rates to encourage savings in peso and to avoid dollar outflows when the government lifts capital controls.

What Bloomberg Economics Says:

“President Javier Milei has made strides on his reform agenda. Next he must lift currency controls and regain access to global capital markets. Argentina may not be ready yet that – the BCRA still has to clean up its balance sheet and reserves are too low to end the controls. Once those are eased or lifted, the next step is positive real rates – they’ve been negative since Milei took office.”

—Adriana Dupita

G-10 CURRENCIES AND EAST EUROPE ECONOMIES

Swiss National Bank

Current policy rate: 1.25%Bloomberg Economics forecast for end of 2024: 1%Bloomberg Economics forecast for end of 2025: 1%The SNB cut rates already in March, pre-empting peers such as the ECB in the neighboring euro zone.

With inflation only at 1.4% — lower than in many other jurisdictions — and forecast to fall further over the year, officials have had fewer impediments to acting than elsewhere.

SNB decisions are scheduled only for once every quarter. Officials reduced borrowing costs again in June, and the question for policymakers now is whether they will extend their easing cycle in September or wait even longer.

Against that backdrop, a changing of the guard is imminent at the central bank. Vice President Martin Schlegel will succeed Thomas Jordan to the top job in October. Having spend his career working closely with the current president, he’s seen by observers as unlikely to make major changes in monetary.

What Bloomberg Economics Says:

“The SNB delivered a second consecutive rate cut, to 1.25%, in June, as political uncertainty in Europe added upside risks to the currency. With policy close to neutral, the SNB is likely to move slower from now – we expect a final rate cut, to 1%, in December, although September remains a possibility, particularly if uncertainty remains high in Europe. The nomination of Schlegel to replace Jordan from October will ensure policy continuity.”

—Maeva Cousin

Sveriges Riksbank

Current policy rate: 3.75%Bloomberg Economics forecast for end of 2024: 3.25%Bloomberg Economics forecast for end of 2025: 2.25%The Riksbank is gaining confidence that inflation won’t exceed its 2% target, and now sees it as likely that it can cut its benchmark rate two or three times more in the second half of the year.

Governor Erik Thedeen and his colleagues were emboldened to chart a slightly more dovish path at their monetary policy meeting last week after seeing that the Swedish krona wasn’t hit by their decision to make the first easing move before the ECB.

Still, the world’s oldest central bank continues to underline the need to unwind constriction in a gradual manner, and a volatile krona remains a risk that could upend its plans, should the currency weaken to an extent that has a tangible effect on inflation through higher import prices.

The bank has four monetary policy meetings left before year-end, and an inflation print published July 12 will be important for its next decision, due to be announced on August 20.

What Bloomberg Economics Says:

“Having kicked off its easing cycle already in May, the Riksbank is flirting with the idea of three more cuts this year, up from its earlier signaling for two. That invites currency weakness when other major central banks deliver messages of hawkish leaning. This adds to reasons why we think the central bank will not be in a position to deliver more than a cut per quarter ahead, taking the end-year rate to 3.25%.”

—Selva Bahar Baziki

The Riksbank Only Sees Cuts Ahead

Norges Bank

Current deposit rate: 4.5%Central bank guidance for end of 2024: 4.5%Norway’s central bank may extend its rate pause until next year after a stronger-than-expected economic outlook and wage growth prompted Norges Bank to scrap its plan to start easing in September.

The energy-rich Nordic economy has proven more resilient to borrowing costs at 4.5% — the highest level since 2008 — and stickier inflation than projected by Governor Ida Wolden Bache and colleagues. At their latest meeting, officials raised their forecasts for economic expansion and pay increases this year and next.

While the strengthening of the krone from its weak levels has brought some relief to policymakers after recent worries about imported inflation, they still revised higher estimates for long-term underlying inflation, with their 2%-target remaining out of reach even by 2027.

Norges Bank’s latest plans confirm its reputation as one of the more aggressively hawkish rich-world central banks, in contrast with most other regional peers including neighboring Sweden and the euro zone that have already started easing.

Reserve Bank of New Zealand

Current cash rate: 5.5%Bloomberg Economics forecast for end of 2024: 4.75%Bloomberg Economics forecast for end of 2025: 3.25%The RBNZ is talking tough, saying it won’t cut rates until the second half of 2025 to make sure sticky domestic inflation is vanquished.

But almost all observers think it will be pressed into action much sooner than that amid mounting signs of economic gloom.

While New Zealand exited recession with 0.2% growth in the first quarter, that may prove to be a temporary reprieve.

With consumer and business confidence in the doldrums, economists predict the economy will shrink again in the three months through June. That would make it five contractions in the past seven quarters.

Investors are betting rate cuts will start in November this year, and most local economists predict easing will begin in early 2025.

What Bloomberg Economics Says:

“The RBNZ joined the high-for-longer bandwagon in May, but its hawkish stance is unrealistic and won’t last long. The economy just barely climbed out of recession in 1Q, and activity indicators suggest significant headwinds going forward. Strong immigration has been propping up demand but this will fade. We see rate cuts coming in late 2024, as the focus switches from fighting inflation to reviving growth.”

—James McIntyre

National Bank of Poland

Current cash rate: 5.75%Bloomberg Economics forecast for end of 2024: 5.5%Bloomberg Economics forecast for end of 2025: 5%Poland’s central bank is likely to keep rates unchanged for the rest of the year as double-digit growth in wages worries policymakers in Warsaw.

While inflation has reached the 2.5% target, the concern is that it will flare up later in the year as the government removes remaining crisis-era measures that have held down energy prices.

Lackluster economic recovery may still swing the majority in favor of cuts earlier, but officials have coalesced around the view that monetary easing may wait until early next year.

Beyond inflation, Governor Adam Glapinski will seek to fend off a parliamentary probe that the ruling coalition has launched into his conduct before last year’s election. The governor has denied any wrong doing.

What Bloomberg Economics Says:

“Poland is likely to lag the ECB’s easing cycle and won’t cut until 4Q. Policymakers’ focus will remain on core inflation and the strength of the recovery. Recent downside inflation and growth surprises may nudge the monetary-policy committee toward a more dovish stance. We expect the central bank to cut the reference rate to 5.0% by end-2025 as inflation stabilizes around the 2.5% target level.”

—Alexander Isakov

Poland Rate Cuts to Lag ECB’s This Year

Czech National Bank

Current cash rate: 4.75%Median economist forecast for end of 2024: 4%The Czechs have signaled they’re likely to slow or may even halt monetary easing — after four consecutive rate cuts by half a percentage point — in the second half of the year as officials aim to prevent inflation from staging a comeback.

While consumer price growth has stabilized near the 2% target, Governor Ales Michl and his colleagues see potential risks in wage growth, rising cost of services and a lending recovery.

“The bank board considers it necessary to persist with tight monetary policy and carefully consider any further rate cuts, approaching them with great caution,” Michl said after the last 50 basis-point reduction on June 27.

--With assistance from Scott Johnson (Economist), Beril Akman, Philip Aldrick, Michael S. Arnold, Bastian Benrath, Walter Brandimarte, Matthew Brockett, Maria Eloisa Capurro, Constantine Courcoulas, Anooja Debnath, Brian Fowler, Toru Fujioka, James Hirai, Claire Jiao, Sam Kim, Andrew Langley, Yujing Liu, Amara Omeokwe, Nduka Orjinmo, Swati Pandey, Reade Pickert, Niclas Rolander, Anup Roy, Piotr Skolimowski, Ntando Thukwana, Manuela Tobias, Ott Ummelas, Monique Vanek and Kira Zavyalova.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

2024-06-30T16:27:22Z dg43tfdfdgfd