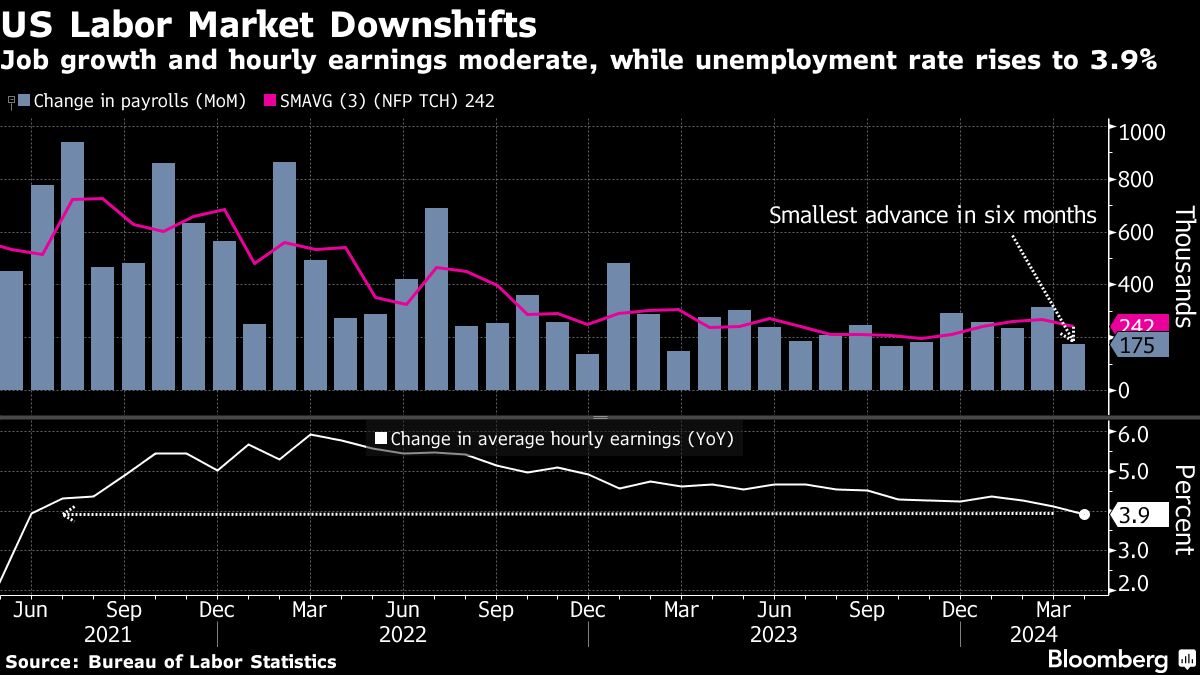

US JOBS POST SMALLEST GAIN IN SIX MONTHS AS UNEMPLOYMENT RISES

(Bloomberg) -- US employers scaled back hiring in April and the unemployment rate unexpectedly rose, suggesting some cooling is underway in the labor market after a strong start to the year.

Nonfarm payrolls advanced 175,000 last month, the smallest gain in six months, a Bureau of Labor Statistics report showed Friday. A later release showed that business activity in the service sector — the largest part of the economy — unexpectedly weakened to the lowest level in four years, while prices climbed.

Click here for the five takeaways from Bloomberg’s TOPLive blog

Friday’s jobs report signaled further evidence that demand for workers is moderating, but the data likely don’t amount to “an unexpected weakening” that Federal Reserve Chair Jerome Powell said would warrant a policy response.

Powell, who spoke Wednesday after the central bank held interest rates steady for a sixth straight meeting, noted that wage growth probably needs to “move down incrementally” for policymakers to meet their inflation objective. Friday’s report showed some movement in that direction after a slew of releases earlier in the week suggested wage pressures continue to bite.

Average hourly earnings climbed 0.2% from March and 3.9% from a year ago, the slowest pace since June 2021. Some economists were expecting a stronger increase in part due to a new California law mandating a $20 minimum wage for fast-food workers, which took effect April 1.

Employment was also weaker in the service-sector report, published later Friday by the Institute for Supply Management. Combined with the jobs data, the figures represent a moderation in demand that may restrain economic growth.

Investors zoned in on the jump in prices in the ISM data, with Treasuries and the S&P 500 paring earlier gains. Traders assigned roughly even odds to a rate cut in September.

“For those looking for a rate cut sooner than later, this deceleration in payroll growth is good news, and the weaker wage growth number makes it even better news,” Olu Sonola, Fitch Ratings head of US economic research, said in a note. “However, one month does not make a trend, so the Fed will likely need to see a few months of this type of moderation coupled with better inflation numbers to put rate cuts back in play sooner than later.”

MetricActualEstimate| Change in payrolls (MoM) | +175,000 | +240,000 |

| Unemployment rate | 3.9% | 3.8% |

| Average hourly earnings (MoM) | +0.2% | +0.3% |

Job growth slowed within leisure and hospitality, construction and government. Payrolls declined at automakers and temporary-help providers. Gains were concentrated in health care, transportation and retail trade.

The labor market, as well as a range of other economic indicators, were robust in the first quarter of the year. Payrolls in January through March averaged 269,000, so Friday’s print is a notable slowdown.

President Joe Biden has been touting the recent strength of the job market as evidence that his policies are helping the economy. He pointed out that the unemployment rate has held below 4% for over two years, according to a statement after the report.

Chicago Fed President Austan Goolsbee also applauded the numbers, calling the headline payrolls gain “very solid.” Additional reports like this one will help policymakers gain confidence that the economy isn’t overheating, Goolsbee said on Bloomberg Television Friday.

What Bloomberg Economics Says...

“April’s weaker-than-expected nonfarm-payrolls print, together with a higher unemployment rate, suggest monetary policy is finally asserting itself on the labor market after a long lag. That could reinforce Fed Chair Jerome Powell’s recent dovishness, as he and his colleagues emphasize their full-employment mandate when deciding on the rate path for the rest of 2024.”

— Anna Wong, Stuart Paul and Estelle Ou. To read the full note, click here

Aggregate weekly payrolls, a broad measure of employment, hours and earnings, were unchanged from a month earlier. That snapped three straight years of monthly advances and, if sustained, raises the risk of a downshift in consumer demand.

The very gradual cooling in hiring and wage growth is part of the reason why policymakers have indicated they’re in no rush to bring interest rates down from a two-decade high. Powell has also nodded to an increase in the supply of workers, boosted in particular by an influx of immigrants.

Read More: Fed’s Bowman Says Inflation to Remain Elevated for ‘Some Time’

The participation rate — the share of the population that is working or looking for work — held steady at 62.7%. The rate for workers aged 25-54 ticked up to 83.5%, matching the highest level in two decades. Increased participation will help to restrain wage growth.

The jobs report is composed of two surveys: one of businesses that generates the payrolls and wage data, and another smaller one of households used to produce the unemployment rate.

The household survey also publishes its own measure of employment, which rose by just 25,000 in April after surging by nearly half a million in the prior month. That may revive questions as to why such a large gap remains between this figure and the headline payrolls number.

Digging Deeper

| The number of weekly hours worked edged down to 34.3The underemployment rate, a broader measure that includes those who prefer full-time work, rose to the highest since November 2021The rise in the unemployment rate mainly reflected people who lost their jobs, as opposed to people who quit or just entered the labor force and couldn’t find workThe number of employees working part-time for economic reasons climbed to the highest since June 2021. That’s perhaps a sign of emerging stress in the labor market |

--With assistance from Kristy Scheuble, Reade Pickert, Daniel Neligh, Matthew Boesler, Mark Niquette, Ye Xie, Steve Matthews and Cécile Daurat.

(Adds ISM data, comments from Fed’s Goolsbee)

Most Read from Bloomberg

- Truce Talks Shift to Qatar as Hamas Hits Israel Border Crossing

- France’s Macron Calls for Reset of Economic Ties With China

- Buffett Praises Apple After Trimming It, Drops Paramount Stake

- Treasury Rally Risks Running Into a $125 Billion Brick Wall

- Xi Begins Europe Tour in Paris as Macron Seeks to Reset Ties

©2024 Bloomberg L.P.

2024-05-03T18:06:41Z dg43tfdfdgfd