SABADELL FAVORS OPENING TALKS WITH BBVA ABOUT TAKEOVER, SOURCES SAY

(Bloomberg) -- Banco Sabadell SA is leaning towards starting takeover talks with larger rival Banco Bilbao Vizcaya Argentaria SA, people familiar with the matter said, potentially taking a first step in a process that could end up creating a new Spanish banking behemoth.

There’s a growing view within Sabadell that the offer BBVA has outlined in a letter is a reasonable starting point for negotiations, although the bank hasn’t made a formal decision on how to proceed, the people said. The lender will continue discussing the proposal over the weekend and may hold a board meeting about it next week, they said asking not to be named as the deliberations are private.

BBVA on Tuesday made a surprise offer to Sabadell to start talks about a takeover. The proposed all-share deal values the smaller bank at a 30% premium to its closing price on Monday — or around €12 billion ($13 billion). It would give Sabadell shareholders a 16% stake in the combined group.

Some executives at Sabadell would prefer the offer to be at least partially in cash, some of the people said.

Spokespeople for Sabadell and BBVA declined to comment.

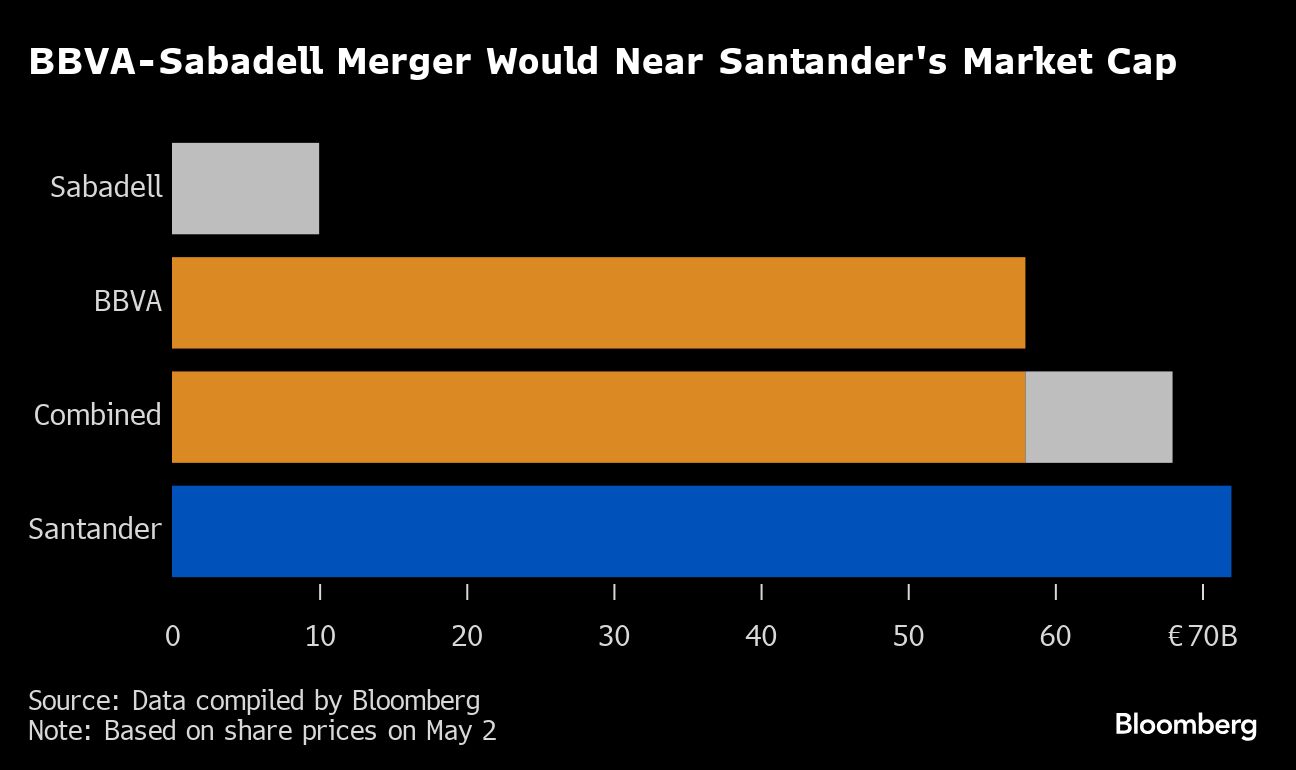

A decision by Sabadell to kick off talks would mark a first step towards what could ultimately become a new Spanish banking giant with a joint balance sheet of more than €1 trillion ($1.1 trillion) in assets. The combined market capitalization of BBVA and Sabadell would be about €70 billion, or roughly equal to the valuation of Spain’s largest lender, Banco Santander SA.

However, before any deal could be sealed, the parties would likely go through tough negotiations including over the ultimate price and the future management setup. A previous attempt by BBVA to buy Sabadell failed over pricing.

When those talks collapsed in late 2020, Sabadell was in worse shape. It had problems in its UK unit TSB and was facing questions over provisions linked to mortgages and its sprawling SME business, one of the largest in Spain, amid the economic collapse caused by the Covid pandemic.

Since then, Sabadell’s valuation has soared as it has fixed TSB while rising interest rates have boosted the European banking industry as a whole.

If Sabadell were to reject the proposal, BBVA could consider going hostile, though that would throw up additional challenges. For example, such an approach may cause concern among regulators, one person said.

Sabadell’s stock was slightly up on Friday, giving the bank a market capitalization of just over €10 billion.

--With assistance from Vinicy Chan.

Most Read from Bloomberg

- Truce Talks Drag as Hamas Hits Israel Crossing in Deadly Attack

- France’s Macron Calls for Reset of Economic Ties With China

- Buffett Praises Apple After Trimming It, Drops Paramount Stake

- Treasury Rally Risks Running Into a $125 Billion Brick Wall

- Xi Begins Europe Tour in Paris as Macron Seeks to Reset Ties

©2024 Bloomberg L.P.

2024-05-03T16:16:23Z dg43tfdfdgfd